2024 Schedule Se Form 1040 Sr

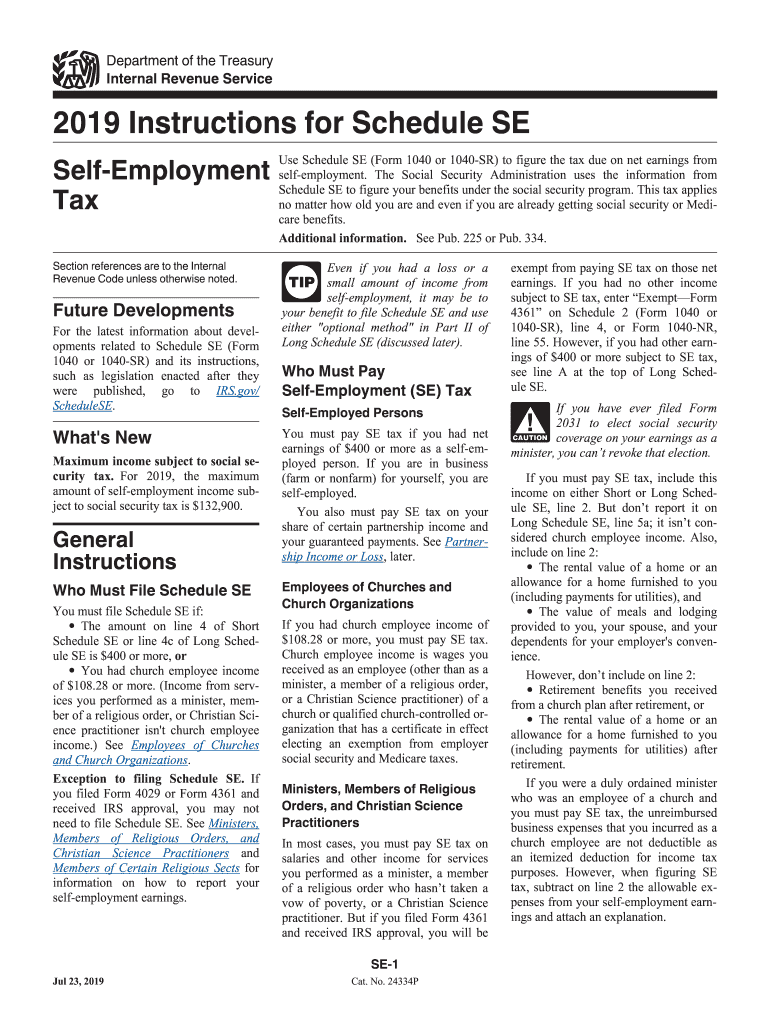

2024 Schedule Se Form 1040 Sr – The Internal Revenue Service (IRS) has released the tax refund schedule the Form 1040EZ. Taxpayers who previously used this form will now be required to use Form 1040 or Form 1040-SR. . who reports them by filing Schedule C along with Form 1040. Owners of single-member LLCs usually have to pay self-employment taxes. Meanwhile, any LLC has the option of asking the IRS to tax it .

2024 Schedule Se Form 1040 Sr

Source : www.irs.govSchedule se 2017: Fill out & sign online | DocHub

Source : www.dochub.comAmazon.com: 1040 U.S. Individual Income Tax Return 2023: includes

Source : www.amazon.com1040 (2023) | Internal Revenue Service

Source : www.irs.govFederal income tax hi res stock photography and images Alamy

Source : www.alamy.comAbout Schedule SE (Form 1040), Self Employment Tax | Internal

Source : www.irs.govIRS Form 1040 Schedule SE Walkthrough YouTube

Source : www.youtube.com2023 Form IRS Instruction 1040 Schedule SE Fill Online

Source : tax-form-1040-instructions.pdffiller.com1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule SE (Form 1040) | Fill and sign online with Lumin

Source : www.luminpdf.com2024 Schedule Se Form 1040 Sr 1040 (2023) | Internal Revenue Service: All gambling winnings must be reported on Form 1040 or Form 1040-SR, including winnings that can be deducted if deductions are itemized on Schedule A (Form 1040) and if you kept a record . What else do you need to know about being a gig worker and taxes? You will use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. And, you may have to make .

]]>